top of page

No Non-Cents Blog

The Hidden Tax Torpedo in the One Big Beautiful Bill—And How to Avoid It

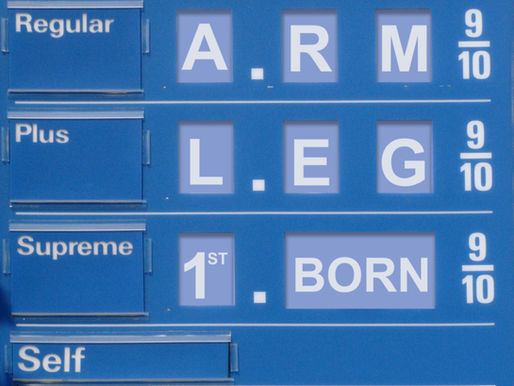

The One Big Beautiful Bill has hit the tax world like a tidal wave. While high-income taxpayers can cheer at the temporary increase in the state and local tax (SALT) deduction, there’s a hidden trap lurking beneath the headlines—a tax “torpedo” that can blow a hole in your bank account if you’re not careful. Think of it as a financial booby trap: you see a treasure chest of deductions, but open it without planning, and—kaboom—your tax bill rockets higher than expected. What

Matthew Delaney

Nov 6, 2025

The Starbucks Dilemma: How Small Daily Choices Shape Long-Term Wealth

One of the most common conversations I have with clients revolves around a simple but powerful question: Where does all the money go? We work hard, we earn a good living, but at the end of the month the checking account seems to drain faster than we’d like. Often, the answer lies not in one large purchase, but in hundreds of small ones. This is what I call the “Starbucks dilemma”—spending more than we realize on coffee, meals, and convenience, while missing the opportunity t

Matthew Delaney

Nov 4, 2025

The Amazon Prime Problem: How “One-Click” Spending Eats Away at Your Future

For years, financial experts have warned us about the “Starbucks effect”—how small, repeated purchases can quietly drain our finances. But in today’s world, there’s a new culprit that deserves just as much attention: the Amazon Prime problem. Amazon Prime is a marvel of convenience. With free shipping, same-day delivery, and millions of products at our fingertips, it’s no wonder 200+ million people around the world subscribe. But the darker side of this convenience is how eas

Matthew Delaney

Oct 27, 2025

When the Government Closes Its Doors: What a Shutdown Really Means for Your Investments

Ah, the government shutdown—a phrase that can send shivers down the spine of even the most seasoned investor. It conjures images of furloughed employees, empty offices, and Washington, D.C., in a state of frozen chaos. But before you start envisioning your 401(k) being eaten by a giant bureaucratic monster, take a deep breath. A government shutdown is rarely the financial apocalypse it’s often made out to be. Let’s take a light-hearted stroll through what a shutdown really me

Matthew Delaney

Oct 15, 2025

How to Talk to Family About Money (So It’s Not Awkward Later)

Money is one of the last real taboos in our culture. We talk about politics, relationships, and health far more openly than we do about...

Matthew Delaney

Oct 7, 2025

Getting Ready to Sell Your Business: What to Do Before You List

Selling a business is often the culmination of years—or decades—of hard work. Whether you’re planning to retire, pivot into a new...

Matthew Delaney

Sep 29, 2025

The Art and Science of Naming IRA Beneficiaries

When it comes to retirement accounts—especially Individual Retirement Accounts (IRAs)—few decisions are more important yet more...

Matthew Delaney

Aug 26, 2025

Retirement Income Planning in a High-Inflation Environment

Retirement planning is always about balance—ensuring your money lasts as long as you do, while still letting you enjoy the life you’ve...

Matthew Delaney

Aug 14, 2025

One Big Beautiful Bill: A Summary for Tax Planning

A sweeping new tax bill—officially called the “One Big Beautiful Tax Bill”—has passed, bringing a mix of extensions, updates, and...

Matthew Delaney

Jul 17, 2025

Social Security Tips, Tricks, and the 2034 Funding Cliff: What You Need to Know

Social Security is a cornerstone of retirement planning in the United States, providing vital income to over 66 million Americans....

Matthew Delaney

Jun 19, 2025

Navigating Inherited IRAs: Understanding the New Rules Effective 2025

Inheriting an Individual Retirement Account (IRA) can significantly impact your financial planning. Recent changes introduced by the...

Matthew Delaney

Jun 5, 2025

The Value Exercise: Aligning Your Finances With Your Values

Are you tired of following expert retirement guidance and still feel unfulfilled? It’s time to try something else: the value exercise.

Matthew Delaney

Feb 12, 2025

The Future of Retirement in a Gig Economy

As retirement plans become uncertain, how does the rise of the gig economy fit in? Read on to see what retirement strategies will look...

Written by Matthew Delaney

Oct 11, 2023

Give it to me Straight…How Much Do I Really Need to Retire Comfortably?

Only a short while ago Baby Boomers became the biggest generation in American history. Since then, Millennials and Gen Z have surpassed...

Written by Matthew Delaney

Apr 30, 2022

Retirement Q&A with Tim Delaney

JDH Wealth is excited to announce Tim Delaney’s retirement! He started the company 21 years ago after a career as a CPA with...

Written by Matthew Delaney

Dec 16, 2021

bottom of page