Reap the Benefits of Tax-Loss Harvesting to Lower Your Tax Bill

- Matthew Delaney

- May 26, 2020

- 5 min read

By Hayden Adams, Author for Charles Schwab

Even in the best of times, not every investment will be a winner. Fortunately, losing investments do have a silver lining: You may be able to use them to lower your tax liability and better position your portfolio going forward. This strategy is called tax-loss harvesting, and it’s one of the many tax-smart strategies that investors should consider.

Tax-loss harvesting generally works like this:

You sell an investment that’s underperforming and losing money.

Then, you use that loss to reduce your taxable capital gains and potentially offset up to $3,000 of your ordinary income.

Finally, you reinvest that money into a different security that meets your investment needs and asset allocation strategy.

The general principle behind tax-loss harvesting is fairly straightforward, but it’s best to do some planning before implementing the strategy to make sure you avoid some common pitfalls.

The basics Imagine you’re reviewing your portfolio and you see that your tech holdings have risen sharply, while some of your industrial stocks have dropped in value. As a result, you now have too much of your portfolio’s value exposed to the tech sector. To realign your investments with your preferred allocation, you sell some tech stocks and use those funds to rebalance. In the process, you end up recognizing a significant taxable gain.

This is where tax-loss harvesting comes in. If you also sell the industrial stocks that have declined in value, you could use those losses to offset the capital gains from selling the tech stocks, thereby reducing your tax liability.

In addition, if your losses are larger than the gains, you can use the remaining losses to offset up to $3,000 of your ordinary taxable income (for married couples filing separately, the limit is $1,500). Any leftover losses can be carried forward to future tax years and used to offset income down the road.

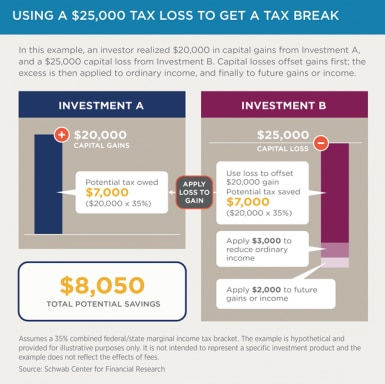

For example, let’s say you recognize a gain of $20,000 on a stock you bought less than a year ago (Investment A). Because you held the stock for less than a year, the gain is treated as a short-term capital gain and will be taxed at the higher ordinary income rates, rather than the lower long-term capital gain rates, which apply to investments held for more than a year. At the same time, you also sell shares of another stock for a short-term capital loss of $25,000 (Investment B). Your $25,000 loss would offset the full $20,000 gain—you’d owe no taxes on the gain and the remaining $5,000 loss could be used to offset $3,000 of your ordinary income. The leftover $2,000 loss could then be carried forward to offset income in future tax years.

Assuming you’re subject to a 35% marginal tax rate, the overall tax benefit of harvesting those losses could be as much as $8,050 ($20,000 of offset capital gain + $3,000 current-year deductible loss against ordinary income × 35% = $8,050 total savings).

Issues to consider As with any tax-related topic, there are rules and restrictions to be aware of before utilizing tax-loss harvesting, including these:

Tax-loss harvesting isn’t useful in retirement accounts such as a 401(k) or IRA, because the losses generated in a tax-deferred account cannot be deducted.

There are restrictions on using specific types of losses to offset certain gains. A long-term loss would first be applied to a long-term gain. A short-term loss would be applied to a short-term gain. If there are excess losses in one category, these can then be applied to gains of either type.

When conducting these types of transactions, you should also be aware of the wash-sale rule, which states that if you sell a security at a loss and buy the same or a “substantially identical” security within 30 days before or after the sale, the loss is typically disallowed for current income tax purposes.

A tax break for ordinary income Even if you don’t have capital gains to offset, tax-loss harvesting could still help you reduce your income tax liability.

Let’s say Sofia, a single income-tax filer, holds XYZ stock. She originally purchased it for $10,000, but it’s now worth only $7,000. She could sell those holdings and take a $3,000 loss. Then, she could use the proceeds to buy shares of ZYY stock (a similar but not substantially identical stock) after determining that it is as good as or better than XYZ, given her overall investment goals and objectives.

Sofia could use the $3,000 capital loss from XYZ to reduce her taxable income for the current year. If her combined marginal tax rate is 30%, she could receive a current income tax benefit of up to $900 ($3,000 × 30% = $900). She could then turn around and invest her tax savings back in the market. If she assumes an average annual return of 6%, reinvesting $900 each year could potentially amount to approximately $35,000 after 20 years.

Harvesting losses regularly and proactively—when you rebalance your portfolio, for instance—can save you money over the long run, effectively boosting your after-tax return.

Comments