top of page

No Non-Cents Blog

The Hidden Tax Torpedo in the One Big Beautiful Bill—And How to Avoid It

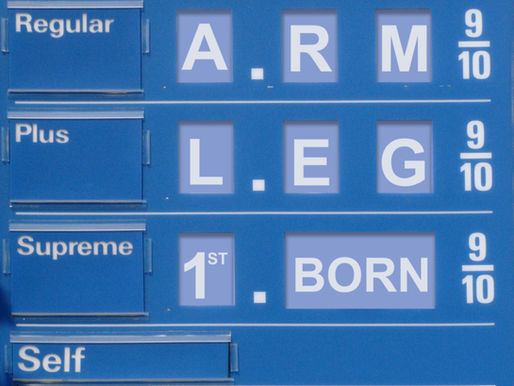

The One Big Beautiful Bill has hit the tax world like a tidal wave. While high-income taxpayers can cheer at the temporary increase in the state and local tax (SALT) deduction, there’s a hidden trap lurking beneath the headlines—a tax “torpedo” that can blow a hole in your bank account if you’re not careful. Think of it as a financial booby trap: you see a treasure chest of deductions, but open it without planning, and—kaboom—your tax bill rockets higher than expected. What

Matthew Delaney

Nov 6, 2025

The Art and Science of Naming IRA Beneficiaries

When it comes to retirement accounts—especially Individual Retirement Accounts (IRAs)—few decisions are more important yet more...

Matthew Delaney

Aug 26, 2025

Retirement Income Planning in a High-Inflation Environment

Retirement planning is always about balance—ensuring your money lasts as long as you do, while still letting you enjoy the life you’ve...

Matthew Delaney

Aug 14, 2025

One Big Beautiful Bill: A Summary for Tax Planning

A sweeping new tax bill—officially called the “One Big Beautiful Tax Bill”—has passed, bringing a mix of extensions, updates, and...

Matthew Delaney

Jul 17, 2025

Philanthropy and Wealth: How Giving Back Can Benefit Your Financial Plan

As you navigate the complexities of wealth management, philanthropy often emerges as a key component of a comprehensive financial plan....

Matthew Delaney

Jul 3, 2025

Navigating Inherited IRAs: Understanding the New Rules Effective 2025

Inheriting an Individual Retirement Account (IRA) can significantly impact your financial planning. Recent changes introduced by the...

Matthew Delaney

Jun 5, 2025

Turning Market Losses into Gains: Why Stock Downturns Offer Tax Loss Harvesting Opportunities

For many investors, a stock market downturn feels like a punch to the gut. You open your portfolio statement or log into your investment...

Matthew Delaney

Mar 20, 2025

Things to Consider Before Buying a Second Home: Is it a Good Investment?

Sixty-five percent of the U.S. population are homeowners. Around four percent also have a second home. But the pandemic, coupled with low...

Written by Matthew Delaney

Jul 26, 2022

Differences Between IRAs, Roth IRAs, and 401(k) Plans

Planning for retirement is a good goal for everyone. For those under forty, the idea of retirement is still nebulous and distant. But for...

Written by Matthew Delaney

Apr 12, 2022

bottom of page